A Complete Guide by MH Solutions Audit Support (Types of Business Audits in the UAE | MH Solutions Audit Support)

In today’s fast-evolving regulatory environment, understanding the Types of Business Audits in the UAE is more than just good practice—it’s a necessity. With stricter laws and financial transparency becoming a business priority, UAE companies must stay ahead by knowing what each audit entails and how to prepare. Whether you’re managing a startup or running a large corporation, MH Solutions is here to simplify the audit process with expert guidance, clarity and compliance support.

Visit mhsolutionuae.com or call us at +971 555594403 for tailored audit assistance.

Why Understanding Audit Types Matters

From tax compliance to corporate governance, different audits serve different purposes. Being aware of these distinctions empowers business owners to meet regulatory standards, avoid penalties and build investor trust. MH Solutions audit support helps you handle each audit type with confidence and professionalism.

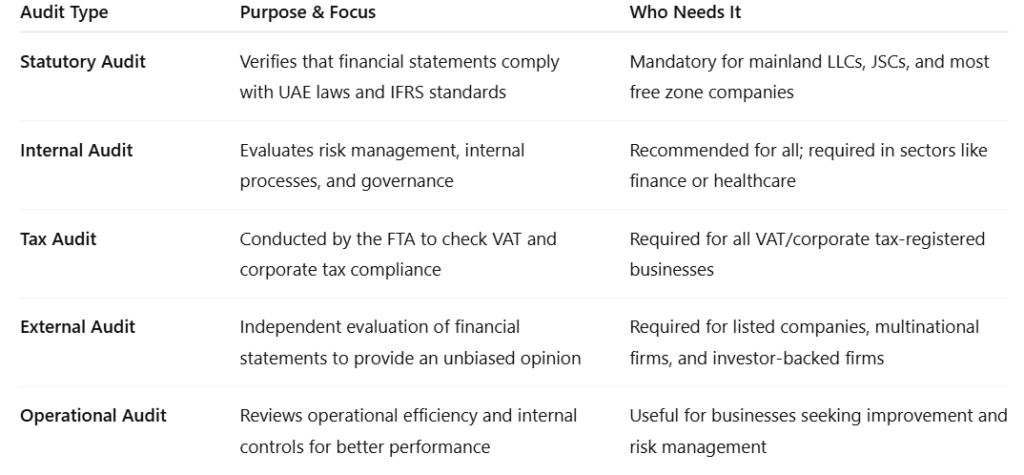

Main Types of Audit in the UAE

Here’s a breakdown of the most common audit types UAE businesses encounter, along with their purpose and who typically requires them:

Audit Requirements: Mainland vs. Free Zone Companies

Mainland Companies:

Under UAE Commercial Companies Law, annual statutory audits are compulsory for LLCs, PJSCs and PrJSCs. Companies must:

- Submit audited financials within 4 months of fiscal year-end

- Follow IFRS standards

- Appoint auditors approved by the Ministry of Economy

Free Zone Companies:

Audit obligations vary:

- Zones like DMCC, JAFZA, and DIFC require yearly audits

- Some smaller free zones may waive this requirement for micro-entities

Still, maintaining proper records is always advisable regardless of the mandate.

UAE Business Audit Checklist: How to Prepare

Proactive preparation is key to a successful audit. Here’s a practical UAE business audit checklist to ensure you’re ready:

- Keep Accurate Records:

Store financial statements, invoices, receipts and contracts securely for at least five years. - Reconcile Regularly:

Match your financial books with bank statements, VAT returns and corporate tax filings. - Assess Internal Controls:

Review processes for payroll, procurement, inventory and compliance regularly. - Prepare for FTA Tax Audits:

Stay audit-ready with complete VAT return documents and corporate tax reports. - Hire Licensed Auditors:

Work with Ministry-approved audit firms like those connected via MH Solutions. - Conduct Pre-Audit Reviews:

Run internal mock audits to detect issues early and resolve them before the official audit. - Meet Deadlines:

File your audited financials on time to avoid penalties or license issues.

MH Solutions Audit Support: Your Trusted Compliance Partner

At MH Solutions, we don’t just prepare you for audits—we stand by you at every stage:

- Audit Readiness Assessment: Identify missing elements and prepare your documentation.

- Licensed Auditor Partnerships: Connect with government-approved professionals for statutory and compliance audits.

- Internal Audit Services: Strengthen governance and internal systems.

- Tax Audit Support: We help you respond to FTA queries with clarity and confidence.

Need help now? Visit mhsolutionuae.com or reach us at +971 555594403.

Customer FAQs

Q1: Who must conduct annual audits in the UAE?

A: All mainland companies (LLCs, PJSCs, PrJSCs) and many free zone entities are legally required to submit audited accounts.

Q2: What happens if I don’t submit my audit on time?

A: Delays can lead to fines, license suspension, or problems with banking and investors.

Q3: How should I prepare for an FTA tax audit?

A: Maintain organized VAT/corporate tax records, reconcile your books and seek MH Solutions audit support for accurate guidance.

Q4: What sets internal and statutory audits apart?

A: Internal audits improve internal controls, while statutory audits confirm financial compliance and are legally mandated.

Q5: How does MH Solutions assist with audit challenges?

A: From document checks to connecting with licensed auditors and post-audit recommendations—we’ve got you covered.

Final Thoughts

Facing an audit doesn’t have to be stressful. With a clear understanding of the types of business audits in the UAE and a solid preparation strategy, your company can turn compliance into a competitive edge. Let MH Solutions audit support be your guide.

Get in touch today via mhsolutionuae.com or call +971 555594403 to secure your compliance and build business trust.