In today’s dynamic business environment, effective accounting is crucial for the growth and compliance of small and medium enterprises (SMEs) in the UAE. As regulations evolve and tax frameworks become more intricate, robust bookkeeping and sector-specific accounting strategies are essential. MH Solutions UAE offers comprehensive accounting services to ensure your business remains compliant, efficient, and poised for growth.

Why Accounting Services Matter for UAE SMEs in 2025

Accurate accounting practices are not just about numbers; they’re about building a solid foundation for your business. Here’s why:

- Regulatory Compliance: The Federal Tax Authority (FTA) mandates maintaining records for at least five years, quarterly VAT returns, and adherence to IFRS standards.

- Avoiding Penalties: Non-compliance can lead to fines up to AED 50,000 for recurring violations.

- Financial Clarity: Proper bookkeeping aids in cash flow management, profitability analysis, and securing funding.

- Tax Efficiency: Timely VAT and corporate tax filings, along with leveraging available reliefs, can optimize your tax obligations.

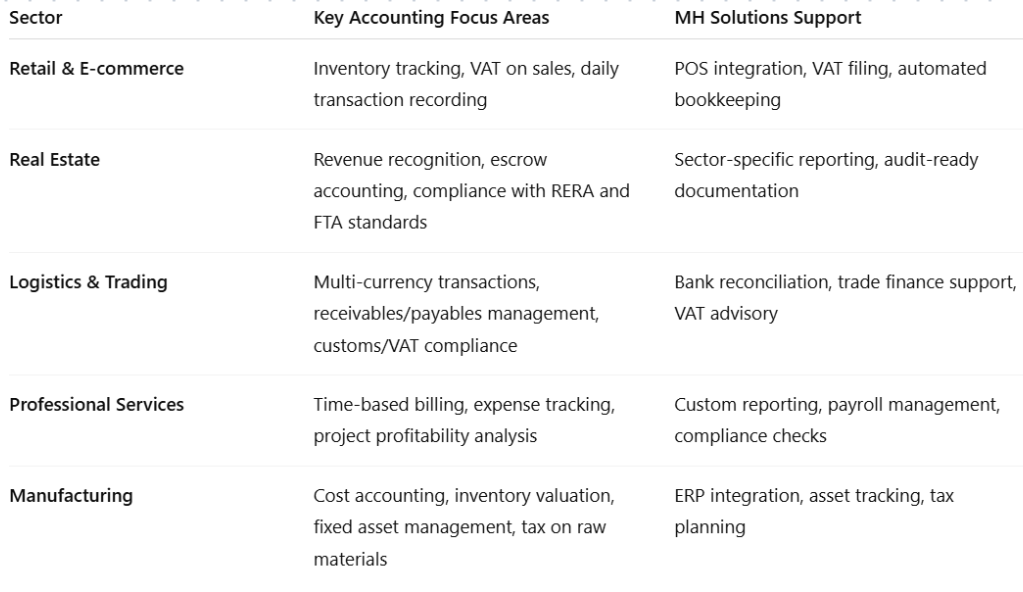

Sector-wise Accounting Best Practices

Different industries have unique accounting needs. Here’s how MH Solutions UAE tailors its services:

Core Accounting and Bookkeeping Practices for All SMEs

Regardless of the sector, certain accounting practices are universally beneficial:

- Maintain Up-to-date & Accurate Records: Promptly record all transactions and categorize revenues and expenses using reliable accounting software.noraal.com

- Separate Business & Personal Finances: Use dedicated business accounts to ensure clarity and compliance.

- Regular Bank Reconciliation: Monthly reconciliation helps detect discrepancies and avoid VAT errors.

- Budgeting & Forecasting: Prepare annual budgets and adjust based on market trends for better financial planning.

- Timely VAT & Corporate Tax Filings: Register for VAT if turnover exceeds AED 375,000 and comply with corporate tax rules.

- Audit Readiness: Regular internal or external audits ensure compliance and build investor confidence.

- Outsource to Experts: Partnering with professional accounting services like MH Solutions UAE ensures tailored, FTA-compliant support.

How MH Solutions UAE Supports SME Compliance

MH Solutions UAE offers end-to-end accounting services, including:

- FTA-compliant bookkeeping and record retention

- VAT and corporate tax advisory and filing

- Sector-specific financial reporting and analysis

- Payroll, budgeting, and cash flow management

- Audit preparation and ongoing compliance monitoring

For more information, visit our website: mhsolutionuae.com or contact us at +971 555594403.

Customer FAQs

Q1: What are the legal accounting requirements for UAE SMEs?

A: SMEs must maintain complete, IFRS-compliant records for at least five years, submit accurate VAT returns quarterly, and comply with corporate tax regulations if profits exceed AED 375,000.

Q2: How can I avoid common bookkeeping mistakes?

A: Keep business and personal finances separate, reconcile bank accounts monthly, record all transactions promptly, and use accounting software or professional services for accuracy.

Q3: When should I register for VAT or corporate tax?

A: Register for VAT if annual taxable turnover exceeds AED 375,000. Corporate tax applies to profits above AED 375,000, with small business relief available for revenues under AED 3 million—application required via the EmaraTax portal.

Q4: What sector-specific accounting challenges should I watch for?

A: Retail faces inventory and VAT complexity; logistics must manage multi-currency transactions; real estate requires compliance with sector regulations; manufacturing needs cost accounting and asset tracking.

Q5: How does MH Solutions UAE customize its services for my industry?

A: MH Solutions UAE provides tailored accounting solutions, leveraging industry expertise to ensure compliance, optimize reporting, and support your business’s unique financial needs.