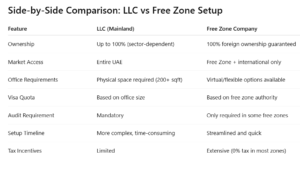

Choosing the right structure to start business in Dubai Free Zone or on the mainland is a vital decision for entrepreneurs and investors. This guide compares Free Zone companies with Limited Liability Companies (LLCs), helping you understand which setup best suits your goals — and answers common customer questions along the way.

Understanding the Options to Start Business in Dubai Free Zone

Dubai’s diverse business landscape gives entrepreneurs two main options: establishing an LLC on the mainland or a Free Zone company. If you’re planning to start business in Dubai Free Zone, knowing the legal, operational, and financial differences between the two structures will guide you in making the best choice.

LLC Setup: When You Need Mainland Access

Key Features:

Ownership: As per new UAE laws, you can now have up to 100% foreign ownership in many sectors, though some still require a local partner.

Market Reach: An LLC allows you to conduct business anywhere in the UAE, including direct dealings with the local market — a major difference if you’re comparing with those who start business in Dubai Free Zone.

Office Space: Requires a physical office of at least 200 square feet.

Visas: The number of visas allowed depends on office size and company activity.

Government Approvals: Multiple approvals from various UAE government entities are often required.

Audit Compliance: Annual audits are mandatory for LLCs.

✅ Best for: Businesses aiming to directly serve the UAE market or require flexibility in operational geography.

Why Entrepreneurs Start Business in Dubai Free Zone

Key Features:

Full Ownership: Enjoy 100% foreign ownership from day one — a core advantage for those who choose to start business in Dubai Free Zone.

Trade Limitations: Business is limited to within the free zone or international trade. Mainland trade requires appointing a local distributor.

Flexible Office Solutions: Options like shared desks, virtual offices, and smart offices are available.

Visa Quotas: Managed by the specific free zone authority and package selected.

Fast Setup: Minimal approvals are required, and documentation is simplified.

Audit Requirements: Only some Free Zones require audits.

Tax Advantages: Many free zones offer zero corporate and income taxes, along with customs benefits.

✅ Best for: E-commerce firms, international traders, and startups wanting full control, speed, and tax benefits.

How to Start Business in Dubai Free Zone: Step-by-Step

Starting a company in a Free Zone is relatively straightforward. Follow these steps to efficiently start business in Dubai Free Zone:

Choose Your Business Activity: Select the service, commercial, or industrial category suited to your company.

Pick a Free Zone: Each zone (e.g., DMCC, IFZA, SPC Free Zone) has its own focus and benefits.

Choose a Legal Structure: Options include Free Zone Establishment (FZE) or Free Zone Company (FZC).

Register Your Trade Name: Check name availability and comply with naming conventions.

Submit Documents: These include passport copies, business plan, application forms, and sometimes MOA.

Lease Office Space: Based on your license and package — virtual or physical offices are available.

Get Your Business License: Once approved, you can commence operations within the Free Zone or internationally.

Customer FAQs – Start Business in Dubai Free Zone

1. Can I start business in Dubai Free Zone with 100% foreign ownership?

Yes. All Dubai Free Zones offer full ownership to foreign nationals without requiring a local partner.

2. Can a Free Zone company operate in the Dubai mainland?

Not directly. You’ll need a UAE-based distributor or agent to legally offer products/services to the mainland.

3. What are the main benefits of starting a business in Dubai Free Zone?

Key benefits include 100% ownership, tax exemptions, simplified licensing, modern infrastructure, and lower overheads.

4. What documents are required to start business in Dubai Free Zone?

Typically required: passport copies, application form, business plan, trade name reservation, and proof of address.

5. How long does it take to set up a Free Zone company?

Usually between 3–10 working days, depending on the Free Zone authority and completeness of your documents.

6. Do I need to rent an office to start business in Dubai Free Zone?

Many Free Zones offer virtual office packages, so a physical space is not always mandatory.

7. Is an annual audit required for Free Zone companies?

It depends on the Free Zone — some require it, others don’t. Always confirm with the zone authority.

Conclusion

Whether you choose an LLC or opt to start business in Dubai Free Zone, both options come with unique advantages. If your focus is on cost-efficiency, fast setup, and international operations, a Free Zone company is ideal. If local market access and wide operational freedom are essential, an LLC might be the better route.

✅ Need help deciding or starting your company setup? MH Solution FZE LLC offers expert advisory, document handling, and full support to help you start business in Dubai Free Zone smoothly and successfully.